Loan platform

Challenges Faced

ICS Funding Pte. Ltd. was established in 2015 with its principal activity as Business Finance Solutions. The company entered the market in the finance industry with growth year over year; along with increased demand from customers.

They aim to be more reachable to our prospective customers and cover majority of the market share. To improve their quality of services, they want to have a digital implementation for both the customers and their organization.

Here are the challenges currently faced:

- To stand out from the presence of competitors

- Legislation may change overnight

- Recovery of debts may be challenging

Solution

Loan process

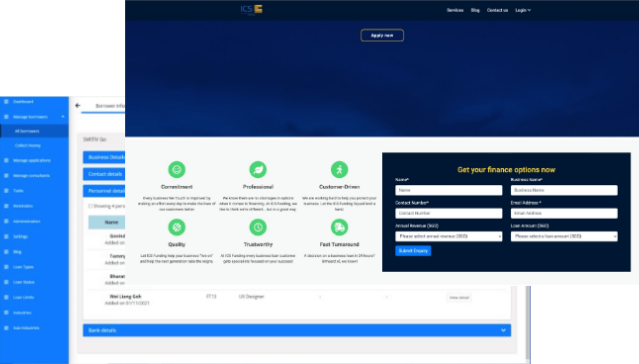

The application, ICS Funding, serves as a portal for corporate clients to apply for loan.

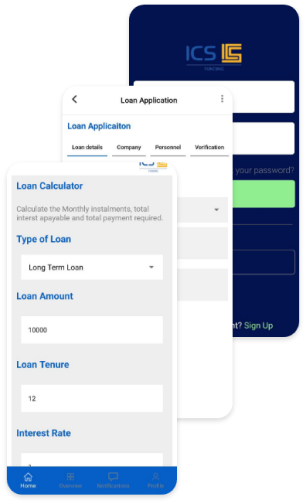

Potential clients can go to our website or app to see the rates online. They can use the loan calculator to get an idea of an amount they want to borrow.

Upon deciding on the amount, they can apply loan through the online forms, which can be manually filled or via Singpass. Once the information are verified, admin will send an offer to the client, which they can either accept, counter-offer or reject. Only when the sum is agreed by both parties, then the loan will be disbursed to the client.

Whenever client makes a monthly repayment, the system will update to show the repayment progress.

Client Management

Client Management are handled through the Web Portal. All the data from the application can be accessed through the Web Portal.

This would include an overview of client list, client’s corporate and individual profile, their loan application and existing loans

Through the Web Portal, the system would be able to automate the tracking of client’s payment and loan collection, which the platform will collate the data collected and create a financial and operations monthly reports.

Result

Improved Customer Satisfaction

With the implementation of the system, clients are able to apply loan online without the need to make an appointment to come down in person. Time taken to conduct business processes is significantly reduced by 4 times. Manual work are now automated. It reduces the manual workload on the staff and they were able to focus on improving the quality of the services which ultimately raised the customer satisfaction.

Less Cost Required

With the system, Automation reduced the need of both manpower and infrastructure. The cost of company is reduced by 2 times, so owner can spend less funds on the current process and allocate more to improve quality of the services.